Kelly Gambling

Introduction

In Kelly gambling (Kelly 1956), we are given the opportunity to bet on n possible outcomes, which yield a random non-negative return of r∈Rn+. The return r takes on exactly K values r1,…,rK with known probabilities π1,…,πK. This gamble is repeated over T periods. In a given period t, let bi≥0 denote the fraction of our wealth bet on outcome i. Assuming the nth outcome is equivalent to not wagering (it returns one with certainty), the fractions must satisfy ∑ni=1bi=1. Thus, at the end of the period, our cumulative wealth is wt=(rTb)wt−1. Our goal is to maximize the average growth rate with respect to b∈Rn:

maximizeb∑Kj=1πjlog(rTjb)subject tob≥0,∑ni=1bi=1.

Example

We solve the Kelly gambling problem for K=100 and n=20. The

probabilities πj∼Uniform(0,1), and the potential

returns rji∼Uniform(0.5,1.5) except for rjn=1,

which represents the payoff from not wagering. With an initial wealth

of w0=1, we simulate the growth trajectory of our Kelly optimal

bets over P=100 periods, assuming returns are i.i.d. over time. In

the following code, rets is the K×n matrix of possible

returns with rows rj, while ps is the vector of return

probabilities (π1,…,πK).

set.seed(1)

n <- 20 # Total bets

K <- 100 # Number of possible returns

PERIODS <- 100

TRIALS <- 5

## Generate return probabilities

ps <- runif(K)

ps <- ps/sum(ps)

## Generate matrix of possible returns

rets <- runif(K*(n-1), 0.5, 1.5)

shuff <- sample(1:length(rets), size = length(rets), replace = FALSE)

rets[shuff[1:30]] <- 0 # Set 30 returns to be relatively low

rets[shuff[31:60]] <- 5 # Set 30 returns to be relatively high

rets <- matrix(rets, nrow = K, ncol = n-1)

rets <- cbind(rets, rep(1, K)) # Last column represents not betting

## Solve for Kelly optimal bets

b <- Variable(n)

obj <- Maximize(t(ps) %*% log(rets %*% b))

constraints <- list(sum(b) == 1, b >= 0)

prob <- Problem(obj, constraints)

result <- solve(prob)

bets <- result$getValue(b)

## Naive betting scheme: bet in proportion to expected return

bets_cmp <- matrix(0, nrow = n)

bets_cmp[n] <- 0.15 # Hold 15% of wealth

rets_avg <- ps %*% rets

## tidx <- order(rets_avg[-n], decreasing = TRUE)[1:9]

tidx <- 1:(n-1)

fracs <- rets_avg[tidx]/sum(rets_avg[tidx])

bets_cmp[tidx] <- fracs*(1-bets_cmp[n])

## Calculate wealth over time

wealth <- matrix(0, nrow = PERIODS, ncol = TRIALS)

wealth_cmp <- matrix(0, nrow = PERIODS, ncol = TRIALS)

for(i in seq_len(TRIALS)) {

sidx <- sample(K, size = PERIODS, replace = TRUE, prob = ps)

winnings <- rets[sidx,] %*% bets

wealth[,i] <- cumprod(winnings)

winnings_cmp <- rets[sidx,] %*% bets_cmp

wealth_cmp[,i] <- cumprod(winnings_cmp)

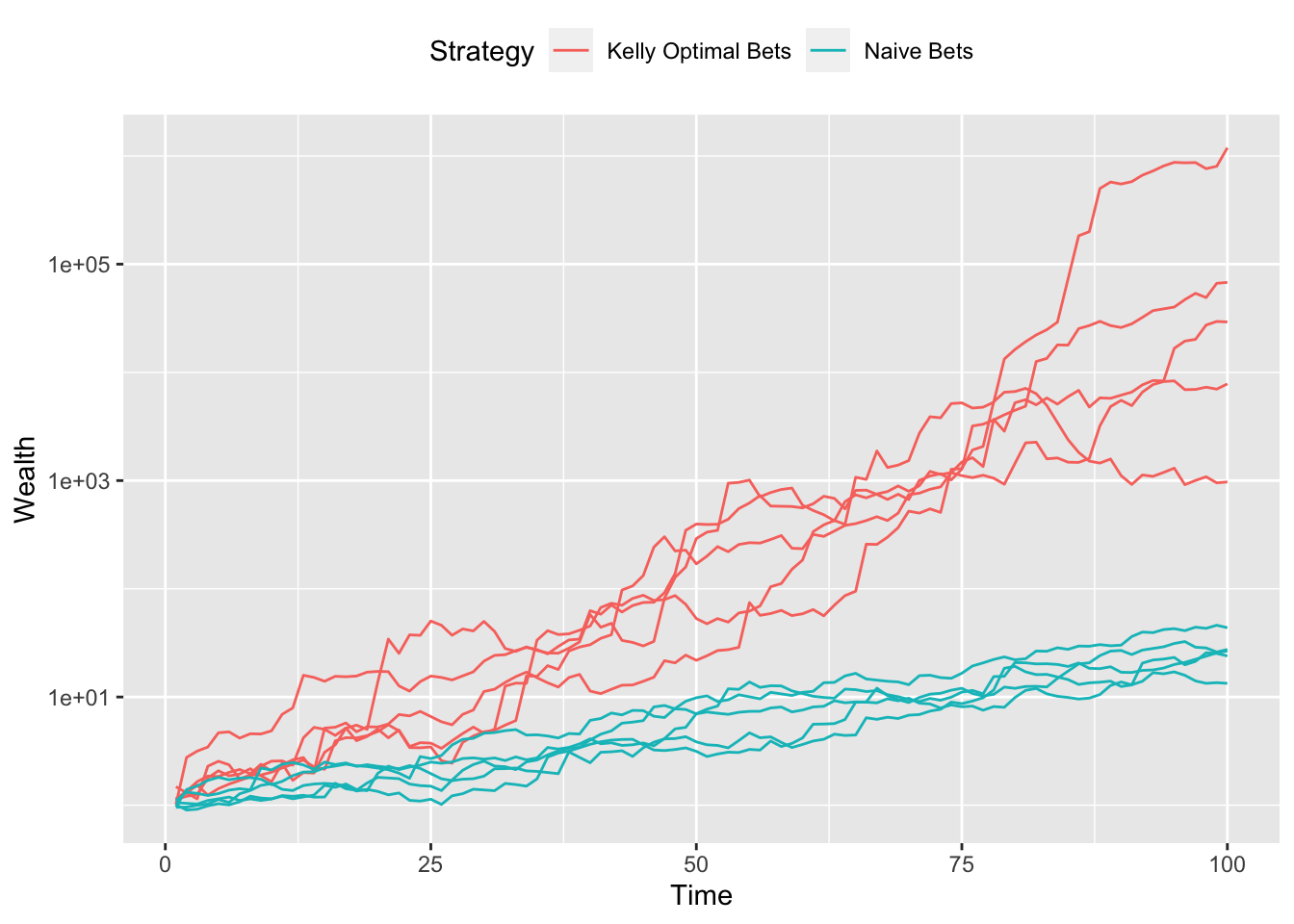

}## Testthat Results: No output is goodGrowth curves for five independent trials are plotted in the figures below. Red lines represent the wealth each period from the Kelly bets, while cyan lines are the result of the naive bets. Clearly, Kelly optimal bets perform better, producing greater net wealth by the final period.

df <- data.frame(seq_len(PERIODS), wealth)

names(df) <- c("x", paste0("kelly", seq_len(TRIALS)))

plot.data1 <- gather(df, key = "trial", value = "wealth",

paste0("kelly", seq_len(TRIALS)),

factor_key = TRUE)

plot.data1$Strategy <- "Kelly Optimal Bets"

df <- data.frame(seq_len(PERIODS), wealth_cmp)

names(df) <- c("x", paste0("naive", seq_len(TRIALS)))

plot.data2 <- gather(df, key = "trial", value = "wealth",

paste0("naive", seq_len(TRIALS)),

factor_key = TRUE)

plot.data2$Strategy <- "Naive Bets"

plot.data <- rbind(plot.data1, plot.data2)

ggplot(data = plot.data) +

geom_line(mapping = aes(x = x, y = wealth, group = trial, color = Strategy)) +

scale_y_log10() +

labs(x = "Time", y = "Wealth") +

theme(legend.position = "top")

Extensions

As observed in some trajectories above, wealth tends to drop by a significant amount before increasing eventually. One way to reduce this drawdown risk is to add a convex constraint as described in Busseti, Ryu, and Boyd (2016, 5.3)

log(K∑j=1exp(logπj−λlog(rTjb)))≤0

where λ≥0 is the risk-aversion parameter. With CVXR,

this can be accomplished in a single line using the

log_sum_exp atom. Other extensions like wealth goals, betting

restrictions, and VaR/CVaR bounds are also readily incorporated.

Session Info

sessionInfo()## R version 4.4.2 (2024-10-31)

## Platform: x86_64-apple-darwin20

## Running under: macOS Sequoia 15.1

##

## Matrix products: default

## BLAS: /Library/Frameworks/R.framework/Versions/4.4-x86_64/Resources/lib/libRblas.0.dylib

## LAPACK: /Library/Frameworks/R.framework/Versions/4.4-x86_64/Resources/lib/libRlapack.dylib; LAPACK version 3.12.0

##

## locale:

## [1] en_US.UTF-8/en_US.UTF-8/en_US.UTF-8/C/en_US.UTF-8/en_US.UTF-8

##

## time zone: America/Los_Angeles

## tzcode source: internal

##

## attached base packages:

## [1] stats graphics grDevices datasets utils methods base

##

## other attached packages:

## [1] tidyr_1.3.1 ggplot2_3.5.1 CVXR_1.0-15 testthat_3.2.1.1

## [5] here_1.0.1

##

## loaded via a namespace (and not attached):

## [1] gmp_0.7-5 clarabel_0.9.0.1 sass_0.4.9 utf8_1.2.4

## [5] generics_0.1.3 slam_0.1-54 blogdown_1.19 lattice_0.22-6

## [9] digest_0.6.37 magrittr_2.0.3 evaluate_1.0.1 grid_4.4.2

## [13] bookdown_0.41 pkgload_1.4.0 fastmap_1.2.0 rprojroot_2.0.4

## [17] jsonlite_1.8.9 Matrix_1.7-1 ECOSolveR_0.5.5 brio_1.1.5

## [21] Rmosek_10.2.0 purrr_1.0.2 fansi_1.0.6 scales_1.3.0

## [25] codetools_0.2-20 jquerylib_0.1.4 cli_3.6.3 Rmpfr_0.9-5

## [29] rlang_1.1.4 Rglpk_0.6-5.1 bit64_4.5.2 munsell_0.5.1

## [33] withr_3.0.2 cachem_1.1.0 yaml_2.3.10 tools_4.4.2

## [37] Rcplex_0.3-6 rcbc_0.1.0.9001 dplyr_1.1.4 colorspace_2.1-1

## [41] gurobi_11.0-0 assertthat_0.2.1 vctrs_0.6.5 R6_2.5.1

## [45] lifecycle_1.0.4 bit_4.5.0 desc_1.4.3 cccp_0.3-1

## [49] pkgconfig_2.0.3 bslib_0.8.0 pillar_1.9.0 gtable_0.3.6

## [53] glue_1.8.0 Rcpp_1.0.13-1 highr_0.11 xfun_0.49

## [57] tibble_3.2.1 tidyselect_1.2.1 knitr_1.48 farver_2.1.2

## [61] htmltools_0.5.8.1 labeling_0.4.3 rmarkdown_2.29 compiler_4.4.2