Portfolio Optimization

Introduction

In this example, we solve the Markowitz portfolio problem under various constraints (Markowitz 1952; Roy 1952; Lobo, Fazel, and Boyd 2007).

We have n assets or stocks in our portfolio and must determine the amount of money to invest in each. Let wi denote the fraction of our budget invested in asset i=1,…,m, and let ri be the returns (, fractional change in price) over the period of interest. We model returns as a random vector r∈Rn with known mean E[r]=μ and covariance Var(r)=Σ. Thus, given a portfolio w∈Rn, the overall return is R=rTw.

Portfolio optimization involves a trade-off between the expected

return E[R]=μTw and associated risk, which we take as the

return variance Var(R)=wTΣw. Initially, we consider only

long portfolios, so our problem is

maximizewμTw−γwTΣwsubject tow≥0,∑ni=1w=1

Example

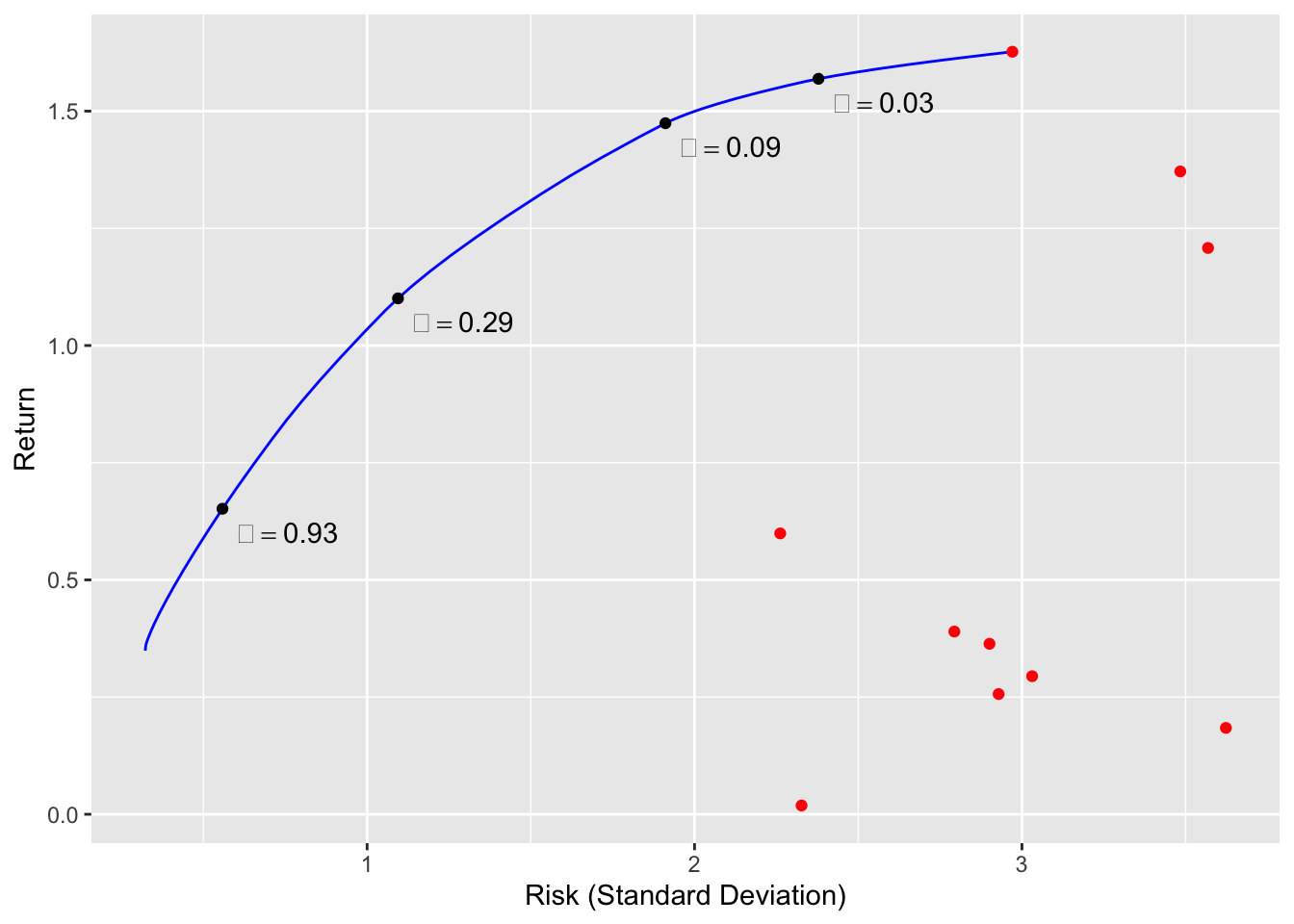

We construct the risk-return trade-off curve for n=10 assets and μ and Σ1/2 drawn from a standard normal distribution.

## Problem data

set.seed(10)

n <- 10

SAMPLES <- 100

mu <- matrix(abs(rnorm(n)), nrow = n)

Sigma <- matrix(rnorm(n^2), nrow = n, ncol = n)

Sigma <- t(Sigma) %*% Sigma

## Form problem

w <- Variable(n)

ret <- t(mu) %*% w

risk <- quad_form(w, Sigma)

constraints <- list(w >= 0, sum(w) == 1)

## Risk aversion parameters

gammas <- 10^seq(-2, 3, length.out = SAMPLES)

ret_data <- rep(0, SAMPLES)

risk_data <- rep(0, SAMPLES)

w_data <- matrix(0, nrow = SAMPLES, ncol = n)

## Compute trade-off curve

for(i in seq_along(gammas)) {

gamma <- gammas[i]

objective <- ret - gamma * risk

prob <- Problem(Maximize(objective), constraints)

result <- solve(prob)

## Evaluate risk/return for current solution

risk_data[i] <- result$getValue(sqrt(risk))

ret_data[i] <- result$getValue(ret)

w_data[i,] <- result$getValue(w)

}Note how we can obtain the risk and return by directly evaluating the value of the separate expressions:

result$getValue(risk)

result$getValue(ret)The trade-off curve is shown below. The x-axis represents the standard deviation of the return. Red points indicate the result from investing the entire budget in a single asset. As γ increases, our portfolio becomes more diverse, reducing risk but also yielding a lower return.

cbPalette <- brewer.pal(n = 10, name = "Paired")

p1 <- ggplot() +

geom_line(mapping = aes(x = risk_data, y = ret_data), color = "blue") +

geom_point(mapping = aes(x = sqrt(diag(Sigma)), y = mu), color = "red")

markers_on <- c(10, 20, 30, 40)

nstr <- sprintf("gamma == %.2f", gammas[markers_on])

df <- data.frame(markers = markers_on, x = risk_data[markers_on],

y = ret_data[markers_on], labels = nstr)

p1 + geom_point(data = df, mapping = aes(x = x, y = y), color = "black") +

annotate("text", x = df$x + 0.2, y = df$y - 0.05, label = df$labels, parse = TRUE) +

labs(x = "Risk (Standard Deviation)", y = "Return")

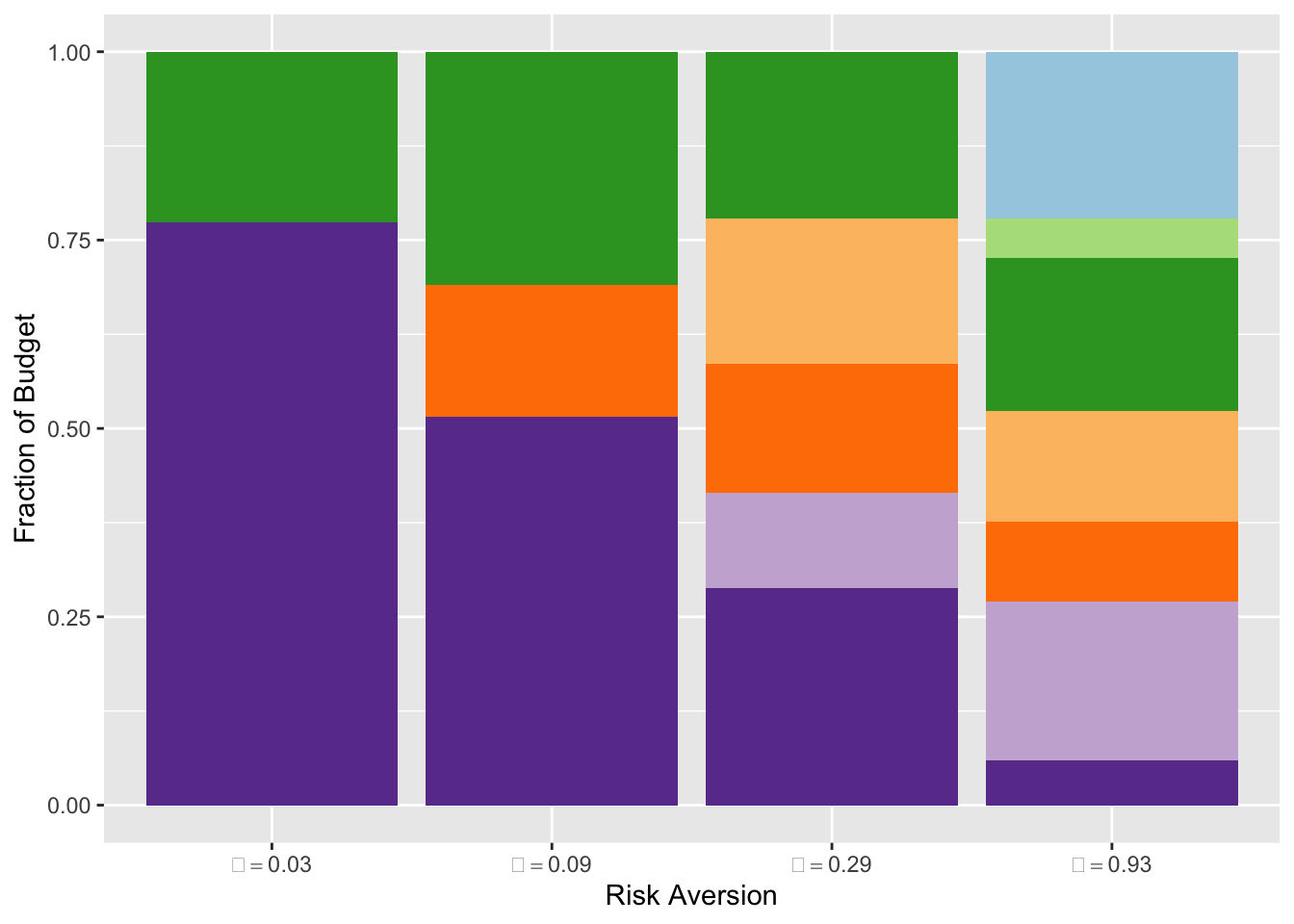

We can also plot the fraction of budget invested in each asset.

w_df <- data.frame(paste0("grp", seq_len(ncol(w_data))),

t(w_data[markers_on,]))

names(w_df) <- c("grp", sprintf("gamma == %.2f", gammas[markers_on]))

tidyW <- gather(w_df, key = "gamma", value = "fraction", names(w_df)[-1], factor_key = TRUE)

ggplot(data = tidyW, mapping = aes(x = gamma, y = fraction)) +

geom_bar(mapping = aes(fill = grp), stat = "identity") +

scale_x_discrete(labels = parse(text = levels(tidyW$gamma))) +

scale_fill_manual(values = cbPalette) +

guides(fill = "none") +

labs(x = "Risk Aversion", y = "Fraction of Budget")

## Testthat Results: No output is goodDiscussion

Many variations on the classical portfolio problem exist. For instance, we could allow long and short positions, but impose a leverage limit ‖w‖1≤Lmax by changing

constr <- list(p_norm(w,1) <= Lmax, sum(w) == 1)An alternative is to set a lower bound on the return and minimize just

the risk. To account for transaction costs, we could add a term to the

objective that penalizes deviations of w from the previous

portfolio. These extensions and more are described in

Boyd et al. (2017). The key takeaway is that all of these convex

problems can be easily solved in CVXR with just a few alterations

to the code above.

Session Info

sessionInfo()## R version 4.4.2 (2024-10-31)

## Platform: x86_64-apple-darwin20

## Running under: macOS Sequoia 15.1

##

## Matrix products: default

## BLAS: /Library/Frameworks/R.framework/Versions/4.4-x86_64/Resources/lib/libRblas.0.dylib

## LAPACK: /Library/Frameworks/R.framework/Versions/4.4-x86_64/Resources/lib/libRlapack.dylib; LAPACK version 3.12.0

##

## locale:

## [1] en_US.UTF-8/en_US.UTF-8/en_US.UTF-8/C/en_US.UTF-8/en_US.UTF-8

##

## time zone: America/Los_Angeles

## tzcode source: internal

##

## attached base packages:

## [1] stats graphics grDevices datasets utils methods base

##

## other attached packages:

## [1] tidyr_1.3.1 RColorBrewer_1.1-3 ggplot2_3.5.1 CVXR_1.0-15

## [5] testthat_3.2.1.1 here_1.0.1

##

## loaded via a namespace (and not attached):

## [1] gmp_0.7-5 clarabel_0.9.0.1 sass_0.4.9 utf8_1.2.4

## [5] generics_0.1.3 slam_0.1-54 blogdown_1.19 lattice_0.22-6

## [9] digest_0.6.37 magrittr_2.0.3 evaluate_1.0.1 grid_4.4.2

## [13] bookdown_0.41 pkgload_1.4.0 fastmap_1.2.0 rprojroot_2.0.4

## [17] jsonlite_1.8.9 Matrix_1.7-1 brio_1.1.5 Rmosek_10.2.0

## [21] purrr_1.0.2 fansi_1.0.6 scales_1.3.0 codetools_0.2-20

## [25] jquerylib_0.1.4 cli_3.6.3 Rmpfr_0.9-5 rlang_1.1.4

## [29] Rglpk_0.6-5.1 bit64_4.5.2 munsell_0.5.1 withr_3.0.2

## [33] cachem_1.1.0 yaml_2.3.10 tools_4.4.2 osqp_0.6.3.3

## [37] Rcplex_0.3-6 rcbc_0.1.0.9001 dplyr_1.1.4 colorspace_2.1-1

## [41] gurobi_11.0-0 assertthat_0.2.1 vctrs_0.6.5 R6_2.5.1

## [45] lifecycle_1.0.4 bit_4.5.0 desc_1.4.3 cccp_0.3-1

## [49] pkgconfig_2.0.3 bslib_0.8.0 pillar_1.9.0 gtable_0.3.6

## [53] glue_1.8.0 Rcpp_1.0.13-1 highr_0.11 xfun_0.49

## [57] tibble_3.2.1 tidyselect_1.2.1 knitr_1.48 farver_2.1.2

## [61] htmltools_0.5.8.1 labeling_0.4.3 rmarkdown_2.29 compiler_4.4.2